Mail Credit Card Payments to:

My Credit Union

PO Box 37035

Boone, IA 50037-0035

Credit Card Phone Numbers (Effective 6/26/2023):

Customer Service - (833) 574-3508

Card Activation - (888) 691-8661

PIN Change - (888) 891-2435

New numbers for reporting lost and stolen debit cards, night and weekend debit card support :

Night and Weekend Card Support, call (844) 454-1358

For Lost/Stolen DEBIT cards, call (800) 528-2273

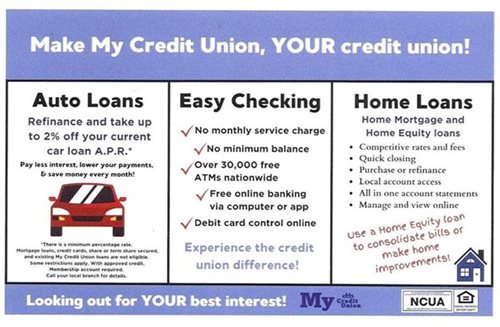

We have over 30,000 surcharge-free ATM's across the United States. To find one near you, use the link below.

https://co-opcreditunions.org/locator

My Credit Union is moving forward with you. We are here to help you in many ways financially and locally, through your neighborhood branch.

We offer Home Equity loans to consolidate debt, make home improvements or whatever the need may be. We are specialists and offer low to no fees. Low rates based on terms.

Refinancing your vehicles with My Credit Union and receiving a lower rate just got easier with online applications. With rates being low, we are making deals on new cars too!

Don't forget, we offer zero balance checking accounts so you don't need to worry about maintaining a certain balance.

"Support your local businesses as we move forward together."

Information to our membership about same day debit and credit postings: